Nothing has the power to cripple a self-employed freelancer quite like freelance taxes.

In fact, I’ve heard of horror stories with freelance businesses shutting down altogether because they didn’t do their taxes right.

Everything was going great! They were making money and had plenty of clients. Then, during tax season, they found out they owed tens of thousands of dollars to the government.

That was enough to send them all back to the corporate jobs they came from destined to have their wages garnished for the foreseeable future and doomed to never freelance again.

It’s scary, right?

You worry you might do something wrong. And, you fear the IRS is going to break down your door, seize everything you own, and throw you in jail as a result.

BUT, it doesn’t have to be that way!

In this article, I hope to help reduce some of the fear that you likely feel around tax season and hopefully offer you some peace of mind regarding freelance taxes.

A General Overview of How Taxes Work

Right off the bat, let me get this out there.

I’m not a tax professional. I’m a web designer.

This is NOT tax advice.

This is what I’ve figured out for myself. If you’d like to use this in your own situation then you do that at your own risk.

Deal?

Okay, let’s move on and chat about a general overview of how taxes work.

If you’ve only ever gotten a paycheck from a company it’s almost mystical how taxes work.

You get a paycheck and kind of notice some weird numbers that talk about things like federal taxes, social security, and other mumbo jumbo things that you’ve only heard in passing when your grandpa had Fox News on in the background at Thanksgiving.

Then, the money that you earned but somehow didn’t make it into your bank account just kind of magically disappears never to be seen again.

What Actually Happens With Withheld Taxes

When your employer pays you, they’re holding back a certain amount of money from each check based on what’s called your taxable liability.

How did they figure out what to withhold? Well, you told them.

Right around the time you first get hired, you fill out a form that gives them a general idea of what they should set aside.

Then, every quarter the company takes all of the taxes that they’ve set aside for each employee and the business itself and they pay the government.

They don’t keep that money aside until the end of the year and cross their fingers hoping they got it right when tax season rolls around. This happens at the end of every quarter.

Filing Without Freelance Taxes

Then sometime around the middle of April, you have to file YOUR OWN taxes for the previous year.

So, you go to a tax professional or fire up Turbo Tax. You fill out some information and figure out if you OVERPAID or UNDERPAID the government during the past year.

A lot of people love getting a ton of money back at the end of the year. But, here’s the thing, you should have had that money all along!

It never belonged to the government. You just lent them money interest-free for an entire year.

That’s what’s called a bad business deal.

Your goal as an employee AND as a freelancer is to owe nothing AND get nothing back at the end of the year.

That means you did your taxes perfectly the entire time.

Your tax return is not a reward. It’s a sign that you didn’t calculate your taxes right AND the government benefited from it.

But, what about freelance taxes? Isn’t that what this whole article is about?

Yes, I was getting to that BUT I needed to lay some groundwork first.

Here are 5 common questions people have about freelance taxes.

1. Should You Hire Someone for Your Freelance Taxes or Do It Yourself?

A lot of people wonder if they should hire a professional to do their freelance taxes OR if they’re better off using something like Turbo Tax and doing it themselves.

I’ve personally gone both routes.

And, to be honest, I’ve found that I typically have to do the same amount of work when I hire an accountant versus when I do it myself. And, I get about the same results.

The benefit of hiring someone is to help you feel a bit safer knowing that a trained professional had a look at what you sent the government.

They MIGHT be able to find some other benefits that you missed, BUT a lot of them are using the same kind of software you would be using with Turbo Tax to find those benefits.

Now don’t get me wrong, if you find yourself in some kind of trouble with the IRS it’s probably worth it to hire someone.

But, in most cases, it’s very likely that you’d be able to figure it out on your own without much trouble.

Ultimately, the decision is up to you. But, personally, I do everything myself.

2. When Do You Pay Your Freelance Taxes?

Just like the company you work for has to pay taxes at the end of every quarter, you also have to pay freelance taxes at the same time.

You can’t wait until tax season to pay everything out if you think you might owe over $500 in taxes to the government in a tax year.

You might pay a penalty for not paying more consistently throughout the year if you don’t do quarterly payouts.

It’s crazy I know.

So, the best thing to do is spend a little bit of time every month to calculate how much you might owe.

Now, I say “MIGHT owe” because until the year is over you’re just kind of guessing.

You could have a big expense that doesn’t come until the last quarter that totally throws off how much profit you made. That could impact how much you should actually be taxed for the other quarters.

Thankfully, most expenses don’t come out of nowhere and you can kind of plan for them.

But, everything gets finalized during tax season.

3. How Much Money Should You Set Aside for Freelance Taxes?

How much money you set aside for your freelance taxes will vary a ton from one freelancer to the next.

But, the general idea is that you take the amount of money you made from your freelance work which is called your income. Then you subtract what you spent on business expenses which is what’s known as your deductions.

Then you take a percentage of what’s leftover and that’s what the government gets.

Unfortunately, you’re responsible to pay MORE taxes as a freelancer than you would pay if you were employed by a company.

That is thanks to the good ole self-employment tax.

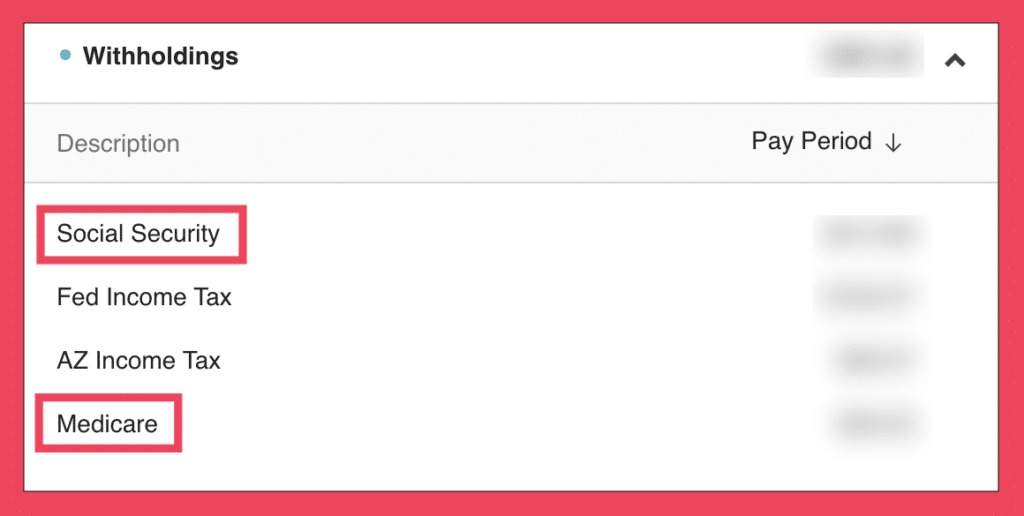

If you look at your paystub there should be a place titled Withholdings. That’s all of the taxes that your company is holding back from paying you.

The federal and state taxes (if you have state taxes) should stay about the same for freelance taxes.

BUT, here’s the bad news: you have to pay nearly double what you normally pay from the combined Social Security and Medicare section.

Lessons From Your Paystub

Why is that?

If you’re working for a company they pay for roughly half of what you owe in those two areas. BUT, you’re on your own if you’re a freelancer.

It sucks, I know. But, that doesn’t change the fact that it is what it is.

Personally, I just set aside about 20% of what I make from my freelance projects rather than figuring out exact prices.

Now, that’s on the lower end of what most people recommend. They say you want to set aside anywhere from 25% to 30%. But, through experience, I’ve found that when I do that I always have leftover money at the end of the year.

And, as I mentioned before, my goal is to use as much money as I can from each paycheck I get.

It might take a little bit of time for you to dial in just how much you should set aside per project. BUT, after a few years, you’ll have a really good idea.

4. What Can You Use as Deductions For Your Freelance Taxes?

Now, time for the good news.

There are expenses that you can count against your taxable income called deductions.

So, let’s say you made $10,000 from a freelance side hustle this last year. And, you had $5,000 worth of expenses from that side hustle.

You’d only get taxed for making $5,000. ($10k income – $5k expenses = $5k taxable income)

So, it’s worth it to keep track of ABSOLUTELY everything you’re spending money on to do business as a freelancer.

What exactly counts as a deduction for freelancers?

I’m so glad you asked! There are loads of things!

- Any subscriptions you have. So, if you pay monthly for Adobe Cloud or Canva or Hosting or whatever it’s a deduction.

- Equipment like computers or other devices

- Depreciation (something losing it’s value) OF that equipment

- Marketing expenses like facebook ads

- The coffee you bought when you were chatting with a potential client

- Even the gas you paid for when you drove out to see that client

Here are a few things to consider when it comes to the deductions you can claim as a freelancer.

Home Office

A home office is a nice deduction for freelance taxes. BUT, there are some pretty stringent guidelines for something to ACTUALLY be considered a home office by the government.

- It has to be a specific space. In other words, you can’t claim your entire house because you’ve got a laptop and wander around while you’re doing work.

- It has to be used REGULARLY and EXCLUSIVELY for the business. That means it can’t also double as a play room for the kids AND you can’t just go in there every once in a while to do work.

If you’ve got something that qualifies then congratulations you’ve got a home office.

Now, you take the square foot of that home office as a percentage of your entire house. That’s the deduction you get.

The good news is you can use that same percentage of utilities as a deduction as well.

Mileage Deductions

You can count the cost of traveling in a vehicle to meet with a client or do other types of business.

With that comes a standard mileage rate that the government puts out every year.

To claim this you’ve got some work to do. You need to keep a running log of the miles that you’re traveling every time it happens.

The government will want to see some record if you should ever be audited.

There are a lot of programs out there that will track the mileage for you on apps to make that easier.

5. Can I Be Audited For My Freelance Taxes?

Being audited is not fun, so I’ve heard. Thankfully, it’s never happened to me.

Can it happen to you? Yes.

BUT, the good news is it’s very unlikely that it will happen to you either. Only about 0.6% of all returns get audited.

Being audited means that the government wants to take a deeper look into a tax return of yours. So, typically, you’ll have to sit down with someone and go line by line proving that what you said on your tax form is all correct.

You’ll need to show receipts and statements, the whole nine yards.

BUT, thankfully, there is a time limit for when the government can audit you.

3 years. They’ve got 3 years to speak up OR their chance to take a deeper look at your taxes goes away.

That means that they can’t go back 10 years ago just to make sure you did everything correctly.

Be Honest and Conservative About Your Freelance Taxes

At the end of the day, a lot of this stuff is a guessing game.

Tax laws are super confusing and even the professionals will admit they don’t understand everything there is to understand about them.

So, it’s always better to play on the safe side.

If there’s a question about whether something can be used as a deduction don’t use it.

I tend to be conservative with my taxes. That’s not to say that I don’t look for every single possibility to pay the government less money in taxes every year.

I’m not trying to let Uncle Sam keep more money than what is owed him.

But, I’m definitely not cutting corners or fudging numbers just to pay less in taxes and neither should you.

The best you can do is keep up with your income and deductions consistently, set a little bit of money aside every time you get paid, and sleep easy at night knowing you’ll probably be alright.

Comments